Important: Starting February 27, 2026, all payment functionality will be moved to GoHighLevel.

gohighlevel users KEEP YOUR payment processing fees!

gohighlevel users Enjoy Saving up to 90% in payment processing fees!

Your Business, Your Profits...

Point. Period. End.

Point. Period. End.

Point. Period. End.

Slash Those Pesky High Merchant Fees – Save Big Now!

Our proprietary payment technology leverages how people Naturally Buy — combined with Strategic Billing Methods — to Slash Processing Fees by 50% to 90% compared to Stripe, PayPal, Square, or Authorize.net!

Your Business, Your Profits...

Point. Period. End.

Cut High Merchant Fees – Big Savings Await!

Our proprietary payment technology leverages how people Naturally Buy — combined with Strategic Billing Methods — to Slash Processing Fees by 50% to 90% compared to Stripe, PayPal, Square, or Authorize.net!

see how impactful this is for your business combined with the gohighlevel platform

The Perfect Payment Solution!

Quick & Easy HighLevel Installation

Highlevel Spotlight Session with Chase Buckner

Quick & Easy HighLevel Installation

Highlevel Spotlight Session with Chase Buckner

Trusted by Entrepreneurs Like You

Here's what you get:

Best Payment Solution for HL

Dual Pricing for Up To 90% in Savings

Reports for Payouts, Refunds, & Voids

So much more...

SLASH FEES

KEEP YOUR MONEY!

How much will you save every month with Noomerik?

Better Than The Rest

Our proprietary payment technology leverages how people Naturally Buy — combined with Strategic Billing Methods — to Slash Processing Fees by 50% to 90% compared to Stripe, PayPal, Square, or Authorize.net!

Can I transfer my customers from stripe?

BONUS FEATURE!

SMOOTH STRIPE MIGRATION!

Our platform ensures an effortless customer migration, without re-entering card details. Enjoy a secure, efficient swap with minimal disruption—ideal for business growth or system upgrades. Migrate hassle-free and keep your operations flowing seamlessly.

Can I transfer my customers from stripe?

BONUS FEATURE!

SMOOTH STRIPE MIGRATION!

Our platform ensures an effortless customer migration, without re-entering card details. Enjoy a secure, efficient swap with minimal disruption—ideal for business growth or system upgrades. Migrate hassle-free and keep your operations flowing seamlessly.

How Our Dual Pricing Technology Works

Watch A Full Demo Here

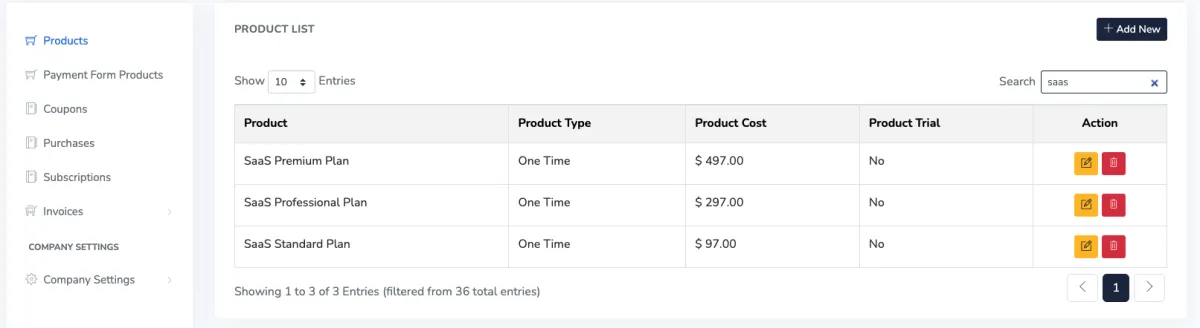

Simple Product

Management

Manage all products and payment forms from one dashboard location inside of Highlevel. Easily create single or recurring products and push them to any payment form on any website or funnel page without needing to make any changes on the page.

Credit Card

AND Echeck

Use our 1 or 2 step order forms and give your customers multiple ways to pay and drop your payment costs by as much as 50%. Credit card and check payments give your customers choices, and when they have choices they will ALWAYS make the best choice for themselves. Our credit card fees are lower than traditional options and when coupled with echecks can drop overall payment costs by as much as 50% or more.

Customer

Membership Portal

It’s no longer necessary to cancel accounts or update client payment details manually. With our member payment portal your clients can update their payment type and information on their own. And you can toggle on or off their ability to cancel their accounts.

Multiple

Product Options

Our payments integration allows you to set up bump offers, payment plans, one time set up fees, free trials and of course single item or recurring payments. And you can do it all through 1 and 2-step order forms that you can completely customize to your business.

Discount

Management

No special coding required. Manage all of your coupons or discounts through our payments dashboard. Set up coupons or discounts that never expire, expire after a certain number of uses or expire them by date.

Affiliate

Residual Income

Create another revenue stream for your business by providing your customers an all-in-one payment solution, delivered simply through a custom payments snapshot. Whether your customers take payments online or in person our omni-channel solution will provide your customers with savings on payment costs and also provide them a way to take payments anytime, anywhere.

Payment

Snapshot

With our custom GHL payment snapshot, powered by industry leading technology that processes over $165 Billion in transactions every year, you’ll be easily onboarded and be able to customize your entire payments experience for yourself and your customers.

Plug & Play Payments

For HighLevel Users

STEP 1

Install The App

Our HighLevel Integration is built to help any business of any size, take payments using HighLevels Payment Forms, Invoices, Payment Links and so forth.

Just navigate to the HighLevel Marketplace today and install the app Noomerik ( Sub Account ).

Step 2

Submit Application

Once you have installed the app, you will be able to Apply. Submitting the application will show a Status of Application message and notify our team and start the underwriting process.

When your application has been approved we will update the status on the application page.

Step 3

Start Taking Payments

Last step is to make Noomerik your default payment provider integration. Once the app is default you will be able to start taking payments!

Just go to Payments > Integrations > Noomerik ( Sub Account) > Manage and then click Default at top right hand corner if not already Default.

Real Business... Real Solutions...

Take Payments Your Way... Or Explore Others such as Dual Pricing, Payment Links, Quotes & Estimates, Invoicing, etc...

Product Management

Manage all products and payment forms from one dashboard location inside of Highlevel. Easily create single or recurring products and push them to any payment form on any website or funnel page without needing to make any changes on the page.

Credit Card & ACH/eCheck

Streamline your checkout offering your customers the choice of credit card or echeck payments while cutting your processing fees by up to 50%. Keep more of your hard earned money then ever before. Your finances will feel the difference!

Multiple Product Options

Our payments integration allows you to set up bump offers, payment plans, one time set up fees, free trials and of course single item or recurring payments. And you can do it all through 1 and 2-step order forms that you can completely customize to your business.

Discount Management

No special coding required. Manage all of your coupons or discounts through our payments dashboard. Set up coupons or discounts that never expire, expire after a certain number of uses or expire them by date.

Affiliate Residual Income

Empower your clients with our custom payment solution that offers a seamless omni-channel experience for both online and in-person transactions, cutting their costs and allowing unlimited payment acceptance anytime, anywhere.

Payment Integration

With our custom GHL payment software, powered by industry leading technology that processes over $200 Billion in transactions every year. Allowing you to customize your entire payments experience for you and your customers.

Invoicing

Our invoicing system seamlessly connects to the contacts in your GHL system so you can send, track and automate off of invoices created, paid or unpaid.

Quoting/Estimating

Our quote system let's you easily send out multiple line item quotes, track accepts and rejects and converts accepted invoices into immediately payable invoices.

Simple Product

Management

Manage all products and payment forms from one dashboard location inside of Highlevel. Easily create single or recurring products and push them to any payment form on any website or funnel page without needing to make any changes on the page.

Credit Card

AND Echeck

Give your customers multiple ways to pay and drop your payment costs by as much as 50%. Credit card and check payments give your customers choices, and when they have choices they will ALWAYS make the best choice for themselves. Our credit card fees are lower than traditional options and when coupled with echecks can drop overall payment costs by as much as 50% or more.

Customer

Membership Portal

It’s no longer necessary to cancel accounts or update client payment details manually. With our member payment portal your clients can update their payment type and information on their own. And you can toggle on or off their ability to cancel their accounts.

Affiliate

Residual Income

Create another revenue stream for your business by providing your customers an all in one payment solution. Whether your customers take payments online or in person our omni-channel solution will provide your customers with savings on payment costs, but provide them a way to take payments anytime, anywhere.

Discount

Management

No special coding required. Manage all of your coupons or discounts through our payments dashboard. Set up coupons or discounts that never expire, expire after a certain number of uses or expire them by date.

Multiple

Product Options

Our payments integration allows you to set up bump offers, payment plans, one time set up fees, free trials and of course single item or recurring payments. And you can do it all through 1 and 2-step order forms that you can completely customize to your business.

Payment

Snapshot

With our payment snapshot, powered by industry leading technology that processes over $165 Billion in transactions every year, you’ll also receive workflow automations for successful, and failed transactions. Additionally you’ll receive customizable payment forms.

We Make It Easy!

Done

For You

We’ll set up your merchant account and install the software into your GHL account.

Ready To Drop Your Payment Costs by 50% or More?

You can get started today or request a demo of how our custom payment system works inside of Highlevel.

Ready To Drop Your Payment Costs by 50% or More?

You can get started today or request a demo of how our custom payment system works inside of Highlevel.

Frequently Asked Questions

How do you get the fees so low?

We use a strategy, and our proprietary technology, to offer Dual Pricing. Your customer can choose from two options when they check out, check or debit/credit card. When they choose debit/credit card the price is slightly higher and therefore it covers the cost of the credit card fees you used to pay. If they choose to pay with a check they will get a slightly lower cost. We see no loss in conversions or sales revenue. Most of our clients have increased their revenue since starting with Noomerik which tells us customers have no complaints at checkout.

What are the costs?

We have a $99 monthly minimum cost whether your process $1 or $10 billion there will always be that minimum. But when you consider that we can help you save 50-90% over Stripe, PayPal, Square and Auth.net the monthly minimum becomes hardly noticeable!

How long does it take to get setup with Noomerik?

We can usually get you approved in as little as one hour of your time. You fill out an application, submit a few documents, we take it through our banks to get underwritten properly, which secures the account for a long future and make Noomerik your Default solution for taking payments within the HighLevel platform.

How much will I save over Stripe, PayPal, Square or Auth.net?

You will typically save 50-90% over these other providers. You can calculate your own savings by going to noomerik.com/savings and you can see what our current clients are saving by going to noomerik.com/proof.

Can I migrate my customers from Stripe without collecting their payment information again?

Yes. We have a seamless system to migrate your existing customers from Stripe without you having to collect their payment information again. It's a simple request from Stripe, an import on our end and then you connect them to products in Noomerik with a few simple clicks. We have clients who have moved over hundreds of subscriptions without any issues.

Does it work with Automations?

Yes. We've built the most extensive third party payment software integration available and it integrates directly through API's. There is no need for webhooks or other platforms like Zapier or Make, we take care of everything inside our software.

Will you freeze my account like Stripe does?

No. Stripe is a "PayFac" which means they have much higher restrictions on their merchant account, which they rent to you. When they take on the risk for an account they actually aren't willing to take on "high risk" businesses like agencies, coaches, consultants, SaaSprenuers and other business owners that "pose to much risk for their business." We actually WANT to work with agencies, coaches, consultants, SaaSprenuers and their clients. We are specifically setup to handle ALL business types, including those in the "high risk" space.

What is considered a "high risk" business?

Any business who does the majority of their sales online, over the phone, including Zoom calls is considered high risk. If the card is "not present" at the time of checkout the business is considered high risk. Any business that sells a future deliverable product, which includes monthly subscriptions for software and/or services is considered high risk. Any business that delivers a "digital product/services" is considered high risk. This doesn't mean you can't have secure payment processing for your business, it just means you need the right partner and provider who WANTS to serve your business, which is Noomerik!

How long does it take for deposits?

Typically 2 business days, however, the more mature the account becomes the more you can move to next day deposits.

Can I get an account if I live outside the US but have a US LLC, EIN and US bank account?

There short answer is no. Even though you may have a US registered business, EIN and bank account merchant banks in the US still require you to have a US working presence. This is most often accomplished if you have an office in the US, a company owner in the US or you travel to the US to work, consistently.

How do you handle chargebacks?

All chargebacks, regardless of provider, are handled by the card brands, Visa/MasterCard/American Express/Discover.

Our system, like others, allows you to dispute the chargeback through an online dashboard where you upload evidence to dispute the chargeback, to 'plead your case.'

We often give general guidance on industry best case scenarios but no one (no matter what you may have heard previously) accept the card brands has control over the process.

And the only way to "prevent" chargebacks is to have an automated system that auto refunds based on pre-set criteria.

Chargebacks are frustrating and a way of life for business owners in today's modern business world, even hotels and car rental agencies deal with them.

The best defense is a good offense (how much you communicate before the sale) and speed of response after a chargeback is filed, always.

How Our Program Works

Step 1

Choose Your Plan

Done For You - we’ll set you up with the technology and processing account to power your savings.

Do It Yourself - we’ll set you up with the technology and you bring a processing account. We are happy to provide you with a recommendation on a processor.

Step 2

Activate Your Account

Whether it’s DFY or DIY we’ll help you set up your account so you can take payments and save money.

Step 3

Install Snapshot & Take Payments

We’ll install the technology and help you get your first products and payment forms set up to take payments.

CUSTOMER CARE

LEGAL

Noomerik, LLC is a financial technology company, not a bank.

Banking services provided by partner banks, members FDIC.

This site is not a part of the Facebook website or Facebook Inc. Additionally, this site NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Copyright 2026. Noomerik. All Rights Reserved.